Notified Bodies in Europe: still too few to meet the MDR/IVDR challenge

Too few Notified Bodies in Europe despite the increase in CE marking applications. Analysis of the 2021-2025 figures and outlook up to 2028.

Índice de contenidos

Index of contents

Index du contenu

Inhaltsverzeichnis

Indice dei contenuti

- Introduction: the paradox of growing demand versus limited supply

- Regulatory context: MDR, IVDR and the role of Notified Bodies

- Some key figures

- The breaking point: why the lack of NBs represents a systemic risk

- Outlook: what to expect by 2028?

- Impacts for manufacturers and PRRCs/QARA teams

- What can be done to improve the situation?

Introduction: the paradox of growing demand versus limited supply

Since the MDR and IVDR came into effect, all medical device manufacturers are required to go through Notified Bodies (NB). Each device or device family must be certified compliant with the regulation to be placed on the European market. Yet, the number of designated bodies remains insufficient to handle the volume of applications.

Regulatory context: MDR, IVDR and the role of Notified Bodies

— Regulation (EU) 2017/745 (MDR), which entered into force on 26 May 2021, replaces the old directives.

— Regulation (EU) 2017/746 (IVDR) for in vitro devices entered into force in 2022.

— Notified Bodies are the entities authorised to carry out conformity assessments, particularly for higher class devices, and are also responsible for evaluating technical documentation, auditing quality systems, etc.

Some key figures

According to MedTech Europe, the Medical Device and In-Vitro sector in Europe accounts for:

- Approximately 38,000 companies

- More than 500,000 devices in circulation in 2025 (of which at least 80% are still under the European Directives 93/42/EEC and 98/79/EC)

The transition to MDR & IVDR

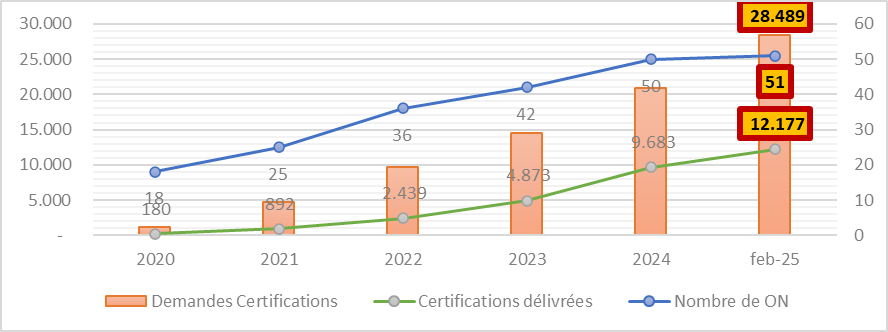

In February 2025, according to data published by the European Commission, the 51 officially designated NBs were responsible for processing around 28,500 certification applications. By the same date, more than 12,000 certificates have been granted, representing 43% of all applications.

What you also need to know:

- On average, the certification process for a single application takes between 13 and 18 months to complete

- Incomplete applications prolong the certification process even further

- Applications can be refused and must therefore be resubmitted

The breaking point: why the lack of NBs represents a systemic risk

— Bottlenecks: existing NBs are overwhelmed by the volume of applications and their resources (expertise, auditors) are limited.

— Increased regulatory complexity: the MDR imposes stricter requirements (clinical, post-market surveillance, enhanced documentation) compared with the former directives, increasing the workload per application.

— Incomplete or poorly prepared applications: these cause significant delays for both NBs and manufacturers.

— Risk of device shortages: if manufacturers fail to obtain certification in time, market access may be delayed, leading to potential shortages in the EU market. One of the key reasons for extending the transitional periods is precisely to avoid such disruptions.

— Mounting time pressure: with the final certification deadline set for 2028, the available transition period is becoming increasingly limited.

Outlook: what to expect by 2028?

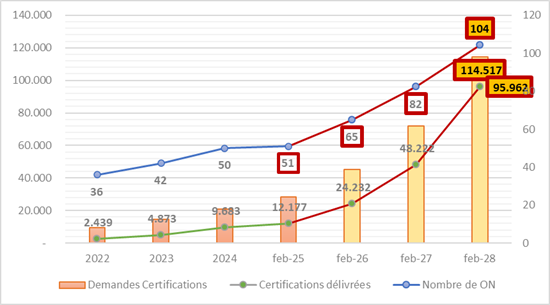

Outlook 1: Based on the rate of NB designations between 2022 and 2025, it is expected that the number could rise from 51 currently to 85 NBs by the end of 2027 and more than 100 in 2028. However, this depends heavily on political will, national investments, and accreditation capacities.

Outlook 2: Continuing the observed trends since 2022, the total number of applications is expected to reach at least 114,000. However, this figure is not fully representative and should be considerably higher as approximately 400,000 devices out of the 500,000 currently on the market must comply with the regulation. And this is despite the possibility of grouping by “device family” (otherwise 1 device = 1 application).

Outlook 3: Based on the current certification rate, it is estimated that 95,000 certificates will be issued in 2028. This still falls short of the 114,000 potential applications in the best-case scenario.

Projected outcomes: If the number of 104 NBs is indeed reached by 2028 and the number of certificates issued is also achieved, this represents 919 certifications per NB. Is this viable?

Impacts for manufacturers and PRRCs/QARA teams

For those responsible for Regulatory Affairs, the pressure is palpable. The various constraints mentioned above (time, budget, regulatory requirements, etc.) make the task particularly challenging because:

— Selecting an NB becomes a strategic challenge: availability, deadlines, expertise, pricing, specialisation by device type.

— Proactive planning is essential: start preparing files well in advance, take advantage of preliminary audits, ensure documentation is complete and compliant.

— Risk of launch delays: even when a product is ready, it must wait for NB review before it can enter the market.

— Occasional reliance on foreign NBs (costs, logistics).

— importance of a stable partnership with the NB: essential for planning surveillance audits, renewals, scope changes, etc.

Despite the best efforts of all parties involved, the complexity of regulatory requirements and the glaring lack of NBs make the task difficult. Key industry players, including the NBs themselves, regularly call on the authorities to highlight structural shortcomings and warn them of the risks of bottlenecks and market shortages.

What can be done to improve the situation?

In the above-mentioned context, there is no miracle solution. If Europe wants to avoid a severe shortage of medical devices, it must act quickly, notably by considering the following proposals:

— Encourage Member States to promote and support the designation of additional NBs.

— Harmonise and simplify certain steps of the evaluation process to reduce the administrative burden (by reviewing certain requirements).

— Strengthen the training of MDR/IVDR expert auditors to increase the pool of available skills.

— Ensure the documentary quality of manufacturers to avoid unnecessary iterations (with clear and precise explanations of what is required).

— Establish a legal response time for NBs?

— Promote collaboration between NBs, national agencies and industry associations to better distribute the workload.

Conclusion: the countdown has begun

The shortage of Notified Bodies in Europe remains one of the major obstacles to a smooth transition to a market that is fully compliant with MDR/IVDR regulations. For both manufacturers and PRRCs/QARA teams, this reality requires a rigorous, forward-looking, and resilient strategy. If the designation of new NBs progresses, it must be accompanied by a real increase in capacity and improved efficiency to prevent widespread bottlenecks by 2028.

Latest figures updated October 2025:

- Notified Bodies for EU Regulation 2017/745 on Medical Devices: 51

- Notified Bodies for EU Regulation 2017/746 on In Vitro Devices: 19

Sources and references

- European Commission – Study supporting the monitoring of the availability of medical devices on the EU market, 2025.

https://health.ec.europa.eu/document/download/59b9d90e-be42-4895-9f6f-bec35138bb0a_en?filename=md_nb_survey_ - MedTech Europe – The European Medical Technology Industry in figures, 2025.

- European Commission – NANDO (New Approach Notified and Designated Organisations) Information System.

https://webgate.ec.europa.eu/single-market-compliance-space/notified-bodies

Other articles you may be interested in:

With a background in Marketing and International Trade, Alex has always shown a passion for languages and an interest in different cultures. Originally from Brittany, France, he has lived in Ireland and Mexico before spending some time back in France and then settling permanently in Spain. He works as Chief Growth Officer at AbroadLink Translations.

Add new comment